Despite a sharp 5% decline in Bitcoin’s price over just 10 hours, Metaplanet and El Salvador have doubled down on their BTC accumulation, signaling unwavering confidence in the digital asset amid heightened market volatility.

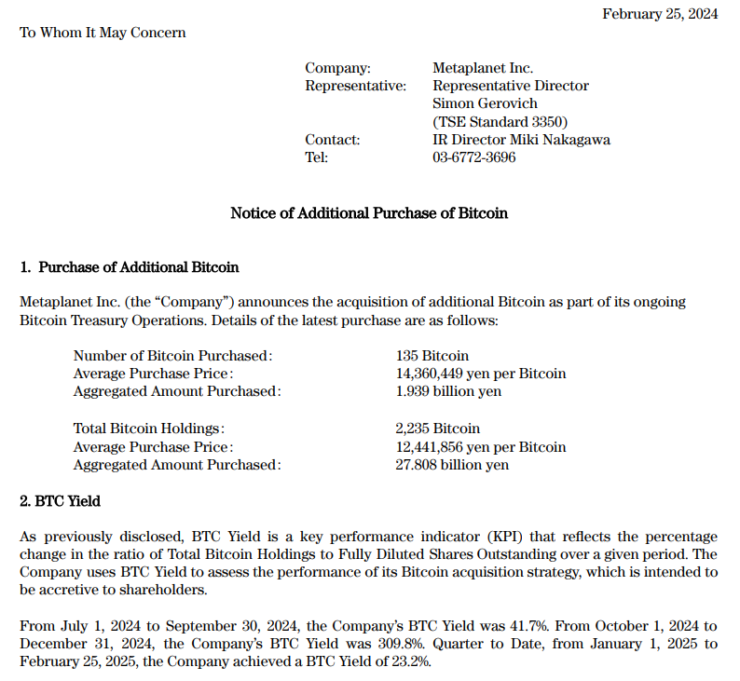

Metaplanet Increases Bitcoin Holdings to 2,225 BTC

As the crypto market braced for a downturn on Feb. 25, Japan-based investment firm Metaplanet announced the purchase of 135 BTC for $13 million at an average price of $96,185 per BTC. Meanwhile, El Salvador stacked an additional 7 BTC around the time Bitcoin was trading at $94,050 on Feb. 24.

However, these buys came just before Bitcoin’s price tumbled below $91,000 in the early hours of Feb. 25. BTC has since rebounded to $92,260, though overall market sentiment has dropped to its lowest level in five months.

Metaplanet’s latest acquisition brings its total Bitcoin reserves to 2,225 BTC, worth over $205 million. With an average purchase price of $81,834 per BTC, the Simon Gerovich-led firm is currently up 12.7% on its Bitcoin investment since first embracing BTC as a treasury asset in April 2023.

More notably, Metaplanet highlighted that its “BTC Yield”—a metric tracking the percentage change in Bitcoin holdings relative to its diluted shares—has surged 23.3% this quarter, putting the firm on course to reach its 35% quarterly target for Q1 2024.

Despite this aggressive accumulation, Metaplanet’s latest purchase failed to boost its stock price. Shares of Metaplanet (TYO: 3350) dropped 0.16% to 6,130 Japanese yen ($41.06) following the announcement, according to Google Finance data.

El Salvador Ramps Up Bitcoin Accumulation

El Salvador’s purchase of 7 BTC marks a notable deviation from its usual “1 BTC per day” strategy, as confirmed by the El Salvador National Bitcoin Office. The acquisition came one hour before former U.S. President Donald Trump reaffirmed his administration’s plan to impose a 25% tax on imports from Canada and Mexico, a move that triggered broader market declines.

The Central American nation’s total Bitcoin reserves now stand at 6,088 BTC, worth approximately $560.7 million at current prices.

Despite its continued Bitcoin accumulation, El Salvador recently agreed to roll back several Bitcoin-related policies as part of a $1.4 billion agreement with the International Monetary Fund (IMF). One key concession involved removing the requirement for merchants to accept Bitcoin as payment.

Bitcoin ETFs See Major Outflows

Meanwhile, institutional investors appeared to reduce exposure to BTC, as at least eight spot Bitcoin ETFs from seven issuers recorded outflows totaling $357.8 million on Feb. 24, according to Farside Investors data.

- The Fidelity Wise Origin Bitcoin Fund suffered the largest outflow of $247 million.

- The BlackRock iShares Bitcoin Trust saw $159 million in outflows, per HODL15Capital’s preliminary data.

What’s Next for Bitcoin?

With Bitcoin’s price volatility persisting, major players like Metaplanet and El Salvador remain committed to long-term accumulation, reinforcing their bullish outlook on BTC’s future. However, contrasting signals from institutional investors reducing ETF holdings highlight the divergence in market sentiment.

As macro uncertainties and regulatory developments unfold, Bitcoin’s next move will be critical in determining whether these accumulation strategies prove prescient or premature.