OX.FUN, the crypto derivatives exchange backed by Three Arrows Capital co-founder Su Zhu, has strongly denied allegations of insolvency following a viral social media claim. As tensions with JefeDAO escalate, the situation underscores the ongoing challenges in DeFi governance and project sustainability.

OX.FUN Pushes Back Against Insolvency Claims

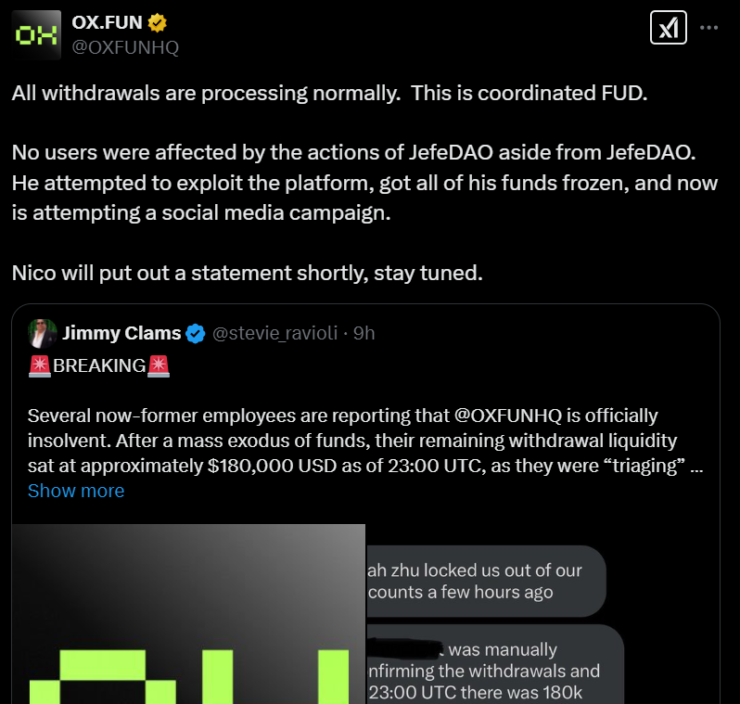

In a Feb. 24 announcement, OX.FUN refuted rumors of insolvency, stating that withdrawals were processing normally and dismissing the claims as “coordinated FUD.”

“All withdrawals are processing normally,” OX.FUN wrote on X, attaching a post that claimed the exchange was insolvent.

The accusation stemmed from X user ‘stevie_ravioli’, who posted that former employees were reporting OX.FUN’s insolvency. The post included a screenshot of an alleged private message from a laid-off OX.FUN employee, claiming there was only $180,000 left for withdrawals as of 23:00 UTC on Feb. 24.

However, the identity of the sender and recipient remains unclear, and OX.FUN did not address the layoffs or remaining funds in its response.

JefeDAO Dispute: The Catalyst Behind the Chaos

The insolvency rumors are rooted in a heated dispute between OX.FUN and JefeDAO.

On Feb. 21, JefeDAO claimed on X that one of its members deposited 1 million USDC into OX.FUN but was unable to withdraw shortly after. The exchange allegedly stated that the user violated its terms of service, though it did not specify how.

OX.FUN founder Nicolas Bayle (alias Nico) fired back, alleging that JefeDAO attempted to exploit the platform, leading to the freeze of its funds.

Extortion Allegations Add Fuel to the Fire

In a follow-up post, JefeDAO accused OX.FUN of attempting to extort them, claiming that Nico offered to return the 1 million USDC only if JefeDAO agreed to promote OX.FUN on social media daily.

“I literally know this is 100% fraud,” JefeDAO wrote. “It is highly unusual and suspicious for an exchange to request marketing in exchange for returning a user’s funds. This is extortion.”

OX.FUN countered by claiming JefeDAO orchestrated a social media smear campaign after its funds were frozen due to an alleged exploit attempt.

Crypto Community Responds with Calls to Withdraw Funds

As accusations escalated, members of the crypto community began urging users to withdraw their funds from OX.FUN. The resulting mass exodus of funds further fueled the insolvency speculation.

“Everyone should remove their funds from OX.FUN immediately!” one X user wrote. “Now it’s clear they’re trying to extort JefeDAO for marketing purposes. This is unacceptable.”

OX.FUN Accuses JefeDAO of Market Manipulation

Late Sunday, OX.FUN published another statement, alleging that JefeDAO engaged in an ‘oracle manipulation attack’.

The exchange claimed that JefeDAO’s 1 million USDC deposit was used to aggressively short the JAILSTOOL memecoin, driving its price from $0.05 to $0.034 before closing short positions at a profit.

“This behavior is explicitly against our Terms of Service,” OX.FUN wrote. “It is against the interest of other users, and thus the funds are frozen.”

The Bigger Picture: DeFi’s Governance Challenges

OX.FUN, launched in January 2024, positioned itself as a gamified crypto derivatives trading platform, with Su Zhu and Kyle Davies serving as advisors. Their previous venture, Three Arrows Capital (3AC), collapsed in 2022, leaving a trail of controversy over insufficient risk management.

This latest debacle highlights the ongoing governance challenges in DeFi, where transparency disputes, fund freezes, and social media-fueled conflicts can destabilize entire projects overnight.

What’s Next?

With the dispute still unresolved, all eyes are on OX.FUN and JefeDAO’s next moves. Will OX.FUN provide further proof of solvency, or will pressure from the community force an external audit?

Regardless of the outcome, this case serves as a stark reminder that trust in DeFi platforms remains fragile, and transparency is more critical than ever.