The price of Raydium’s RAY token took a sharp nosedive on Feb. 24 following speculation that Pump.fun a Solana-based memecoin launchpad is developing its own Automated Market Maker (AMM). If true, this move could disrupt Raydium’s dominance in Solana’s DeFi space, sparking concerns over liquidity shifts and market impact.

Pump.fun’s Alleged AMM Testing Sends Shockwaves Through DeFi

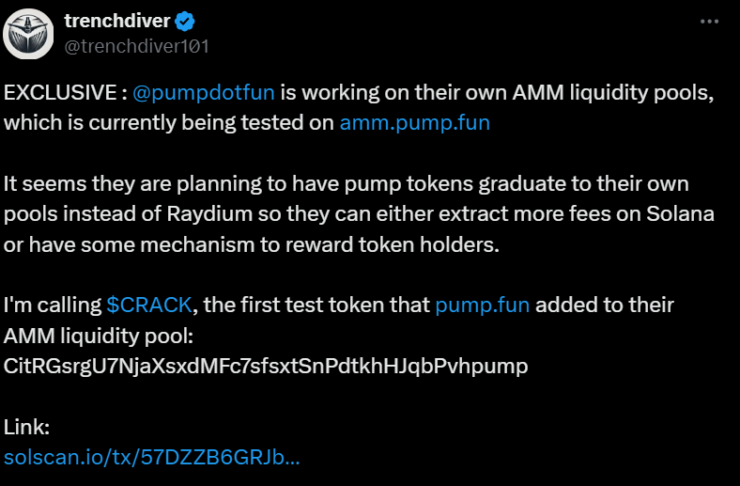

The rumor originated from X user “trenchdiver”, who claimed that Pump.fun is actively testing AMM liquidity pools. This feature would allow users to trade crypto against liquidity in a smart contract, eliminating the need for a traditional counterparty.

Supporting this claim, trenchdiver shared a link showing an AMM interface branded with Pump.fun’s logo, with a beta status displayed. If launched, Pump.fun’s AMM could bypass Raydium’s current role in Solana’s ecosystem, fundamentally changing how new tokens transition from Pump.fun to broader trading markets.

“It seems they are planning to have Pump tokens graduate to their own pools instead of Raydium so they can either extract more fees on Solana or have some mechanism to reward token holders,” said trenchdiver.

First Onchain Transactions Fuel Speculation

Adding fuel to the fire, onchain transactions from Feb. 20 seemingly indicate that Pump.fun added its first test token to its AMM liquidity pool. The test token, called Snowfall (CRACK)—a reference to the 2017 TV series dramatizing the 1980s crack epidemic soared to a $5.4 million market cap just an hour after trenchdiver’s post, per DEX Screener data.

However, CRACK’s price rapidly collapsed, plunging 40% within an hour, with its market capitalization now at $1.8 million.

Despite growing speculation, Pump.fun has not publicly confirmed nor denied its AMM ambitions.

RAY Token in Freefall as Investors React

As the rumors spread, Raydium’s RAY token faced brutal sell-offs. Crypto analyst and podcast host Tyler Warner highlighted that RAY was “falling off a cliff”, losing 25% of its value within 24 hours, now trading at $3.22, according to CoinGecko.

Potential Fee War Between AMMs?

If Pump.fun launches its AMM, it could introduce higher swap fees than Raydium’s standard 0.25% AMM fee, potentially doubling its revenue, according to Shoal Research founder Gabriel Tramble.

“Degens are accustomed to paying high fees for trades,” Tramble added, suggesting that traders may still flock to Pump.fun’s ecosystem despite increased costs.

According to DefiLlama data, Pump.fun has already collected over $500 million in fees since its January 2024 launch, proving its ability to capture market demand despite fee structures.

What’s Next for Raydium and Solana DeFi?

If Pump.fun moves forward with an AMM launch, Raydium could face a major challenge to its dominance in Solana’s DEX ecosystem. The ability to retain liquidity and trader confidence will be crucial as competition heats up.

With market volatility high, investors are left watching closely for any official announcements from Pump.fun or Raydium.

Will Raydium adapt and counter Pump.fun’s potential move, or is Solana’s DeFi landscape about to experience a power shift? Time will tell.