The Arbitrum DAO’s recently-formed Growth Management Committee (GMC) has stirred controversy with a proposal to allocate 7,500 ETH—valued at approximately $20.2 million—to three major decentralized finance (DeFi) protocols: Lido, Aave, and Fluid. None of these protocols are native to the Arbitrum ecosystem, sparking criticism from community members who argue the plan undermines Arbitrum-native projects.

The GMC defended the proposal, stating that Lido, Aave, and Fluid “represent safe applications that achieve conservative yield and strongly support ecosystem growth.” The committee believes these investments would generate low-risk returns while enhancing liquidity across Arbitrum’s DeFi landscape.

However, the proposal has been met with significant pushback. Critics argue that allocating substantial funds to external platforms sends a negative message about Arbitrum-native protocols, implying they are less capable or secure. Several DAO delegates have voiced concerns that the move prioritizes external growth at the expense of nurturing homegrown projects, which could hinder long-term ecosystem development.

The proposal is part of Arbitrum’s broader strategy to reinvest its Ethereum holdings into yield-bearing opportunities, aiming to maximize returns while fostering DeFi growth. Yet, the current plan has exposed divisions within the community, particularly regarding how the DAO should balance external investments with supporting internal projects.

With the Snapshot vote on the proposal scheduled for February 27, the debate continues to intensify. Should the proposal fail to pass, the GMC has indicated they are open to community feedback and would revise their approach accordingly.

Details of the Proposal

According to the proposal, 5,000 ETH would be allocated to Lido’s liquid staking protocol in exchange for 5,000 wrapped staked ETH (wstETH) tokens. These tokens would then be deposited into Aave V3 on Arbitrum, with the goal of encouraging borrowing activity and benefiting from a planned incentive program involving Lido, Aave, Renzo, and Kelp. The remaining 2,500 ETH would be invested into the Fluid lending protocol on Arbitrum, expected to generate a modest native ETH yield of 1-2% while enhancing liquidity in the ecosystem.

The GMC stated that this strategy was chosen after evaluating proposals from 45 different protocols, including Arbitrum-native options like Dolomite, GMX, and Camelot. Despite this, the committee ultimately prioritized non-native platforms, arguing that the selected protocols offer safer, more established yields and stronger support for ecosystem growth. They project that the wstETH deposits will yield around 4.54%, while the Fluid allocation will provide additional liquidity and stable returns.

Community Concerns

One of the loudest critiques came from Arbitrum delegate WonderX,’ who called out the complete omission of native projects, highlighting the lost opportunity to signal support for builders choosing Arbitrum over competing chains.

“This is total bullshit. You are going to invest eth earned on arbitrum one. Not a single project is native. Native projects like gmx and camelot made arbitrum what it is today . This is a total disappointment. total failure,” WonderX wrote in response to the proposal.

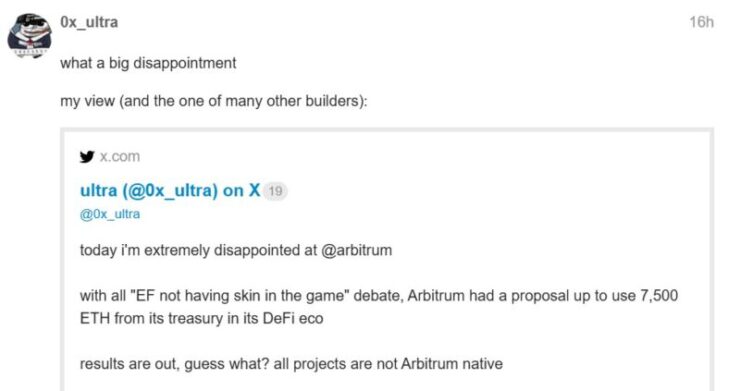

Another delegate, known as ‘ultra,’ echoed similar frustrations in a post on X, arguing that the GMC’s recommendations imply that none of Arbitrum’s native projects are worthy of the treasury’s backing.

Quick Facts:

- Arbitrum DAO’s GMC proposes investing 7,500 ETH into non-native DeFi protocols Lido, Aave, and Fluid to generate low-risk yields and enhance ecosystem growth.

- Critics argue the proposal neglects Arbitrum-native projects, suggesting a portion of funds be allocated to internal initiatives.

- The proposal is set for a Snapshot vote on February 27; failure to pass may lead to revisions based on community input.