Bitcoin’s future has long been a subject of debate, but Marc Boiron, CEO of Polygon Labs, is making a bold prediction: the world’s largest cryptocurrency could surge to $250,000. Boiron argues that Bitcoin’s fixed supply and increasing demand make its long-term appreciation inevitable, despite short-term volatility.

His forecast comes at a time of heightened market uncertainty, with recent security breaches and regulatory shifts shaping investor sentiment. In an interview on Roundtable, Boiron emphasized Bitcoin’s unique value proposition, describing it as a financial asset with predictable fundamentals.

Bitcoin’s Fixed Supply and Growing Demand

Boiron’s confidence in Bitcoin’s future is rooted in its scarcity. Unlike traditional currencies, Bitcoin has a maximum supply of 21 million coins. This inherent limitation, he argues, creates a natural price floor as demand rises. With institutional investors increasingly viewing Bitcoin as a hedge against inflation, Boiron sees a clear trajectory toward higher valuations.

“You have this asset with a fixed supply, and all you need to determine is whether demand for this asset will increase or not. It’s literally that simple,” he stated.

This perspective aligns with historical trends. Over the past decade, Bitcoin has experienced multiple boom-and-bust cycles, but each downturn has eventually led to new all-time highs. Boiron believes this pattern will continue as Bitcoin adoption accelerates.

Market Volatility and Bitcoin’s Resilience

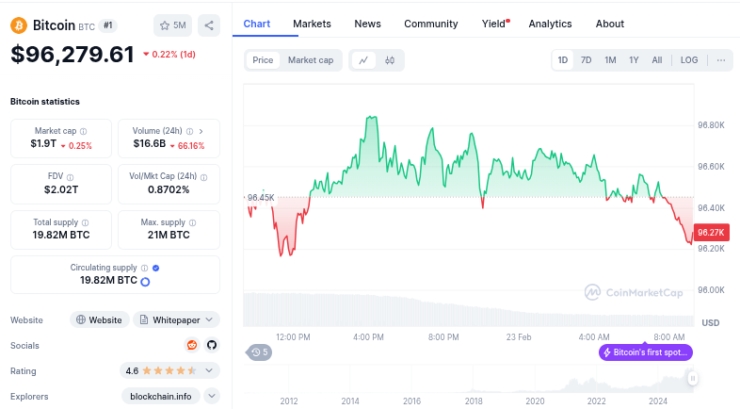

Boiron’s bullish outlook stands in stark contrast to recent market turbulence. A major cyberattack on Bybit, one of the world’s largest crypto exchanges, led to a temporary dip in Bitcoin’s price. On Friday, Bitcoin fell below $97,000 after hackers stole more than $1.4 billion, with security experts pointing to North Korea’s Lazarus Group as the likely culprit.

Despite these setbacks, Bitcoin has shown resilience. As of now, it is trading at $96,333, reflecting only a slight decline in the face of a major security incident. This ability to withstand external shocks reinforces Boiron’s view that Bitcoin remains one of the least risky investments in the long term.

While some analysts remain skeptical of such an ambitious price target, Boiron’s reasoning is based on Bitcoin’s historical performance and the fundamental principles of supply and demand. With increasing institutional adoption and Bitcoin’s inherent scarcity, he sees no reason why the price won’t continue to climb.