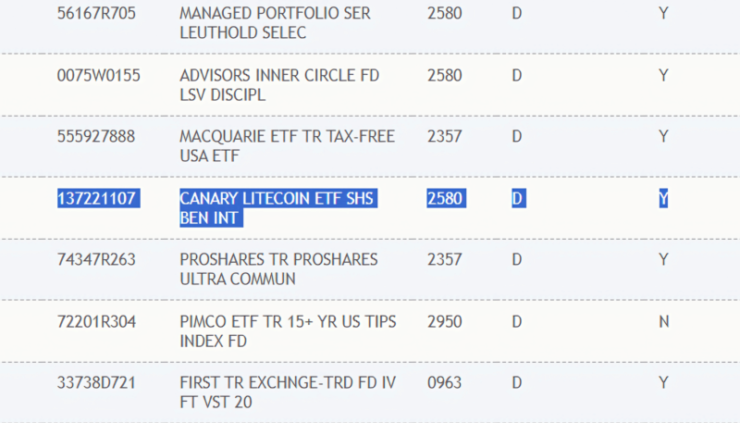

Canary Capital’s proposed spot Litecoin Exchange-Traded Fund (ETF) has been officially listed on the Depository Trust and Clearing Corporation (DTCC) under the ticker LTCC. The DTCC, a critical infrastructure provider in the financial markets, facilitates post-trade clearance, settlement, and custody services for securities, including ETFs, according to Nasdaq.

The listing of the Canary Litecoin ETF on the DTCC is a crucial step in the ETF launch process, signaling that the necessary trading infrastructure is being established. While this development is generally seen as a positive indicator for an ETF seeking to go live, it does not imply regulatory approval. The U.S. Securities and Exchange Commission (SEC) still needs to approve the ETF before it can begin trading on public markets.

Litecoin to Become the Third Crypto With a Spot ETF

Under SEC regulations, the commission has 45 days from the publication of the 19b-4 proposal in the Federal Register—which occurred on February 4—to approve, deny, or extend the review period for the proposed rule change. This window can be extended up to 90 days, allowing the SEC to thoroughly evaluate the fund and gather public input before making a final decision.

If approved, the Canary spot Litecoin ETF would mark a significant milestone, potentially becoming the first spot ETF tied to a cryptocurrency outside of Bitcoin and Ethereum. The fund would allow investors to gain direct exposure to Litecoin’s price movements without the need to hold the digital asset directly.

The SEC’s review of the Canary ETF comes amid a surge of interest in altcoin-based ETFs. Multiple issuers have recently submitted applications to launch spot ETFs for XRP, Solana (SOL), and Dogecoin (DOGE), many of which have been acknowledged by the SEC.

Industry experts are optimistic about the chances of the Canary spot Litecoin ETF receiving the green light. Bloomberg ETF analysts Eric Balchunas and James Seyffart have expressed positive convictions concerning the potential approval of the filing. Their confidence is primarily based on Litecoin’s classification as a commodity by the Commodity Futures Trading Commission (CFTC), which simplifies the path to regulatory approval.

Concerning the Canary Litecoin ETF appearing on the DTCC list, Senior Bloomberg ETF analyst, Eric Balchunas commented:

“Doesn’t mean it’s approved or ready to start trading, but it does show the issuer is making preparations for when it is. We still at 90% odds.”`

The anticipation surrounding the ETF has positively influenced Litecoin’s market performance. Since the initial ETF filing in October 2024, Litecoin’s price has more than doubled, currently trading around $134.81.

Quick Facts:

- DTCC Listing: Canary Capital’s spot Litecoin ETF is now listed under the ticker LTCC, a preparatory move pending SEC approval.

- Approval Odds: Analysts remain positive on the chance of SEC approval for the spot Litecoin ETF in 2025.

- Market Impact: Litecoin’s price has more than doubled since the initial ETF filing, reflecting increased investor interest.

- Expanding Crypto ETFs: The industry is witnessing a rise in ETF applications for various cryptocurrencies, signaling broader institutional adoption.