A growing coalition of crypto firms and industry leaders is backing Senator Ted Cruz in a high-stakes battle to repeal the IRS’s controversial DeFi broker rule, which could impose strict compliance measures on decentralized exchanges and DeFi platforms.

The rule, finalized in the final days of the Biden administration, expands the definition of a “broker” under U.S. tax law to include software providers that facilitate access to DeFi protocols. If implemented in 2027, it would force decentralized platforms to comply with the same reporting requirements as traditional financial institutions, a move industry leaders argue would cripple innovation and push DeFi development offshore.

Crypto Industry Pushes Back: A Unified Front Against Regulation

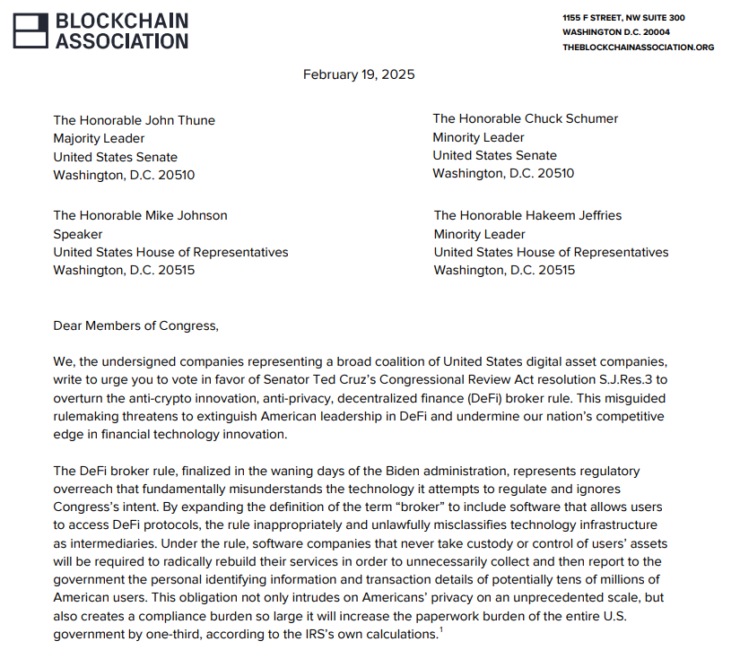

On February 19, the Blockchain Association, a lobbying group representing 76 cryptocurrency organizations, sent a letter urging congressional leaders to support Ted Cruz’s Congressional Review Act (CRA) resolution, S.J.Res. 3, which seeks to repeal the IRS rule before it takes effect.

The letter was addressed to:

- Senate Majority Leader John Thune

- Senate Minority Leader Chuck Schumer

- House Speaker Mike Johnson

- House Minority Leader Hakeem Jeffries

Among the major crypto firms that signed the letter were:

- 0x Labs

- a16z Crypto (Andreessen Horowitz’s crypto division)

- Aptos Labs

- Crypto.com

- Grayscale

- Dapper Labs

- Ava Labs

What’s at Stake? The Industry’s Warning to Congress

The IRS disclosed on December 27, 2024, that up to 875 DeFi brokers in the U.S. would be affected by the new regulation. The Blockchain Association and other industry leaders argue that the rule imposes unjustified burdens on American DeFi companies and could:

- Force DeFi platforms to rebuild their services to comply with government reporting requirements.

- Compromise user privacy, requiring DeFi applications to collect and report personal identifying information and transaction details of millions of U.S. users.

- Push crypto innovation out of the U.S., driving businesses to jurisdictions with more favorable regulatory environments.

“Under the rule, software companies that never take custody or control of users’ assets will be required to radically rebuild their services in order to unnecessarily collect and then report to the government the personal identifying information and transaction details of potentially tens of millions of American users.” – Blockchain Association

A Midnight Regulation? Industry Calls Out the Biden Administration

Crypto advocates have slammed the DeFi broker rule as “midnight rulemaking” a regulatory move pushed through at the end of an administration without full congressional review.

The Blockchain Association argues that such a sweeping policy should not be enacted unilaterally, emphasizing that Congress, not unelected regulators, should determine the future of crypto tax laws.

What Happens Next? The Battle Over DeFi’s Future

Ted Cruz’s CRA resolution represents the industry’s best chance to overturn the IRS’s broker rule before it takes effect. If Congress votes in favor of repeal, it would be a major victory for the crypto sector, signaling that regulators cannot impose sweeping restrictions without proper oversight.

However, if the IRS rule remains in place, it could mark one of the most significant regulatory crackdowns on DeFi in the U.S., forcing platforms to comply with stringent reporting laws or shut down entirely.

The crypto industry now finds itself at a crossroads. Will Washington listen to its warnings, or will the U.S. risk falling behind as DeFi innovation shifts elsewhere? The next few months will be critical in determining whether crypto regulation in America remains balanced or veers toward overreach.