In a bid to position itself as a premier hub for digital assets, Hong Kong has introduced a comprehensive roadmap aimed at enhancing its virtual asset ecosystem. Speaking at Consensus Hong Kong, one of the world’s largest cryptocurrency conferences, local regulators announced new initiatives aimed at boosting the city’s standing in the global crypto market.

The highlight of the event was the Securities and Futures Commission (SFC) granting a virtual asset trading platform license to Bullish, a New York-based cryptocurrency exchange. The announcement of Bullish’s license approval coincided with the opening day of Consensus Hong Kong, organized by CoinDesk, a subsidiary of Bullish. This marks the first major expansion of the flagship crypto conference since Bullish acquired CoinDesk in 2023.

Held at the Wan Chai Exhibition Centre, the conference brought together top figures in the crypto industry, including Binance CEO Richard Teng and Tron founder Justin Sun, who took the stage to discuss the evolving digital asset landscape.

“We have to think how are we going to provide a regulatory framework for growth which allows for responsible innovation … and tapping into global liquidity,” SFC Chief Executive Julia Leung said during a panel discussion, as reported by SCMP Media

SFC’s ASPIRe Roadmap: A Blueprint for Digital Asset Integration

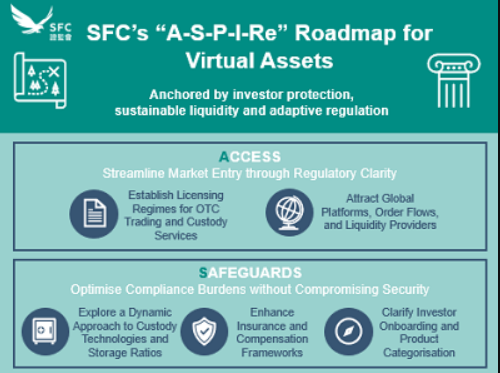

The Securities and Futures Commission (SFC) of Hong Kong has launched the “ASPIRe” roadmap, detailing 12 key initiatives designed to bolster market access, security, and product offerings within the virtual asset space. This strategic plan is structured around five core pillars: Access, Safeguards, Products, Infrastructure, and Relationships.

- Access: Streamlining market entry by introducing new licensing frameworks for over-the-counter (OTC) trading and custodial services.

- Safeguards: Enhancing investor protection through refined operational requirements and compliance measures.

- Products: Expanding the range of virtual asset offerings, including new token listings and derivatives.

- Infrastructure: Modernizing market oversight by leveraging advanced technologies to ensure integrity.

- Relationships: Promoting collaboration with industry stakeholders through continuous dialogue and regulatory refinement.

Dr. Eric Yip, Executive Director of Intermediaries at the SFC, emphasized the dynamic nature of this roadmap, stating that it serves as a “living blueprint” inviting collective efforts to advance Hong Kong’s vision as a global hub where innovation thrives within regulatory guardrails.

Regulatory Enhancements and Industry Collaborations

In alignment with the ASPIRe roadmap, Hong Kong is actively exploring the introduction of cryptocurrency derivatives and margin lending products for investors. Julia Leung, Chief Executive of the SFC, announced these potential plans at the Consensus Hong Kong 2025 conference. Additionally, the city has issued nine licenses for digital asset trading platforms, with eight more under review. Financial Secretary Paul Chan noted that efforts are also underway to regulate stablecoins, further solidifying Hong Kong’s comprehensive approach to virtual asset integration.

Hong Kong’s proactive measures come at a time when global financial centers are intensifying efforts to attract digital asset investments. Singapore and Dubai have implemented favorable regulatory frameworks to lure cryptocurrency businesses and investors, creating a competitive landscape. Hong Kong’s strategic initiatives, including potential tax exemptions on gains from cryptocurrencies for hedge funds and family offices, underscore its determination to remain at the forefront of this rapidly evolving sector.

Quick Facts:

- ASPIRe Roadmap Launched: The SFC’s 12-initiative plan focuses on enhancing market access, security, and product offerings in Hong Kong’s virtual asset sector.

- Hong Kong has granted nine licenses to digital asset trading platforms, with eight additional applications under review.

- Global Competition: Hong Kong’s initiatives reflect its commitment to competing with other financial hubs like Singapore and Dubai in the burgeoning digital asset market.