Japanese energy consulting firm Remixpoint has recorded an 8,000% surge in cryptocurrency holdings over nine months, marking one of the most significant corporate crypto investments in Japan’s history. The firm allocated 9 billion yen ($59 million) to digital assets as part of its treasury management strategy, elevating its holdings from 68 million yen in March 2024 to 5.8 billion yen by the end of December.

The company’s portfolio consists of 125.2 Bitcoin, alongside holdings in Ethereum, Solana, XRP, and Dogecoin. This investment expansion comes as Remixpoint shifts towards integrating cryptocurrency transaction services into its energy consultancy operations, following a model similar to Japanese investment firm Metaplanet.

Market Reaction and Financial Performance

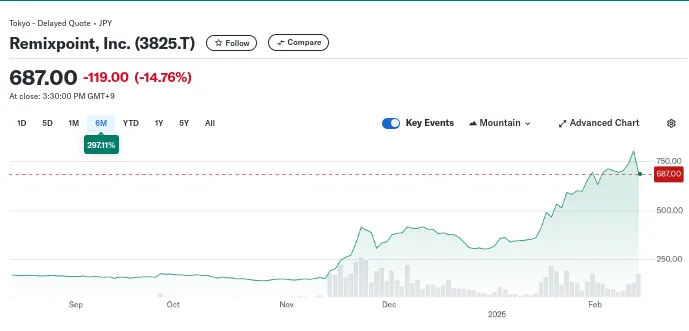

Remixpoint’s bold foray into cryptocurrency coincided with market fluctuations influenced by geopolitical events. Following Donald Trump’s election victory, the company’s stock price soared 360%, fueled by investor optimism regarding potential regulatory changes favorable to digital assets. However, recent financial disclosures led to a 15% decline in its share price, contrasting with a 0.79% dip in the broader Nikkei 225 index.

The firm’s third-quarter earnings report revealed a profit of 1.35 billion yen, with 658 million yen in unrealized gains from cryptocurrency holdings. Starting in November 2024, Remixpoint began including these gains and losses as part of its revenue calculations, aligning with evolving corporate reporting practices in the crypto sector.

Strategic Expansion and Crypto Accumulation

Remixpoint’s investment strategy has been driven in part by concerns over the yen’s depreciation, prompting the firm to seek alternative stores of value. The company has maintained a steady accumulation of digital assets throughout 2024, increasing its purchasing activity in later months as cryptocurrency prices rallied.

Having spent nearly its entire 10 billion yen ($65 million) target, Remixpoint has positioned itself as one of Japan’s largest corporate holders of digital assets. While the firm has not disclosed the precise current value of its holdings, its financial presentations indicate a continued commitment to its cryptocurrency strategy despite market volatility.

The firm’s dual focus on energy consulting and digital asset services mirrors a broader trend among Japanese companies integrating blockchain technology into their operations. As the market assesses Remixpoint’s long-term viability in the crypto sector, its strategy reflects a growing shift among traditional businesses toward digital asset investments as a hedge against economic uncertainty.