The prolonged legal standoff between Ripple and the U.S. Securities and Exchange Commission (SEC) could be nearing an unexpected resolution. With the Trump administration ushering in a crypto-friendly regulatory landscape, speculation is mounting that the SEC may soon drop its appeal against Ripple, the company behind the XRP cryptocurrency. A recent 60-day pause in the SEC’s lawsuit against Binance has added to the anticipation that Ripple’s case might follow a similar trajectory.

Ripple, which launched its payments network in 2012, has been in legal limbo since the SEC sued the company in 2020, alleging that XRP was an unregistered security. The case saw a partial resolution in August 2024 when a federal court ruled that XRP might only be considered a security under certain conditions, specifically when sold to institutional investors. However, the SEC appealed, prolonging the uncertainty surrounding the cryptocurrency’s status.

The appointment of Mark Uyeda as the acting SEC chairman, along with Trump’s expected nomination of Paul Atkins—who has been a vocal advocate for the crypto industry—has signaled a potential shift in the SEC’s stance. Under Uyeda’s leadership, the agency has established a task force to craft regulations and review existing cases, raising the possibility that the Ripple lawsuit could soon be reconsidered.

Ripple’s Scrutiny and XRP’s Role in Payments

Ripple’s payments network, Ripple Payments (formerly RippleNet), enables banks to settle transactions instantly, even across different financial infrastructures. Unlike traditional cross-border payments, which can take days to clear, Ripple’s system allows institutions to use XRP as a bridge currency, reducing costs and streamlining transactions.

Despite XRP’s utility, the SEC’s argument hinges on the fact that Ripple controls the release of the cryptocurrency, with 42.3 billion XRP still held by the company. This, the SEC contends, makes XRP a security rather than a decentralized asset like Bitcoin. However, a judge’s 2024 ruling weakened the SEC’s position by affirming that XRP’s retail sales did not constitute securities transactions.

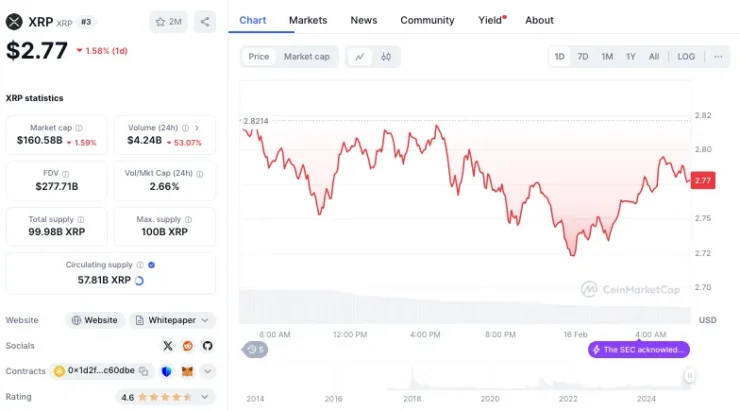

XRP’s price has surged in response to favorable regulatory signals. Following the SEC’s acknowledgment of applications for XRP exchange-traded funds (ETFs) from Grayscale and NYSE, the cryptocurrency jumped 14% to $2.75. Bloomberg Intelligence analyst James Seyffart noted that the previous SEC leadership would likely have dismissed such applications outright, further reinforcing the belief that the new administration is softening its approach.

A Turning Point for XRP and Crypto Regulation

The SEC’s handling of Ripple’s case could set a precedent for future crypto regulation. Trump’s pro-crypto stance, coupled with the SEC’s recent moves, has increased optimism that Ripple’s legal troubles may soon end. Ripple’s Chief Legal Officer, Stuart Alderoty, has expressed confidence that the SEC will drop its appeal, though some analysts believe the decision may hinge on Atkins’ confirmation as SEC chairman.

The potential settlement of the Ripple case also opens doors for broader developments in the crypto market. The SEC’s acknowledgment of an XRP ETF is seen as a landmark shift, with JPMorgan projecting more than $8 billion in inflows if such funds gain approval. Meanwhile, Ripple’s CEO, Brad Garlinghouse, has highlighted increased U.S.-based transactions, suggesting that the company is preparing for regulatory clarity.

Although XRP has gained significant momentum, the cryptocurrency’s long-term value remains uncertain. While banks can use Ripple Payments without XRP, speculation and regulatory clarity may continue to drive its price.