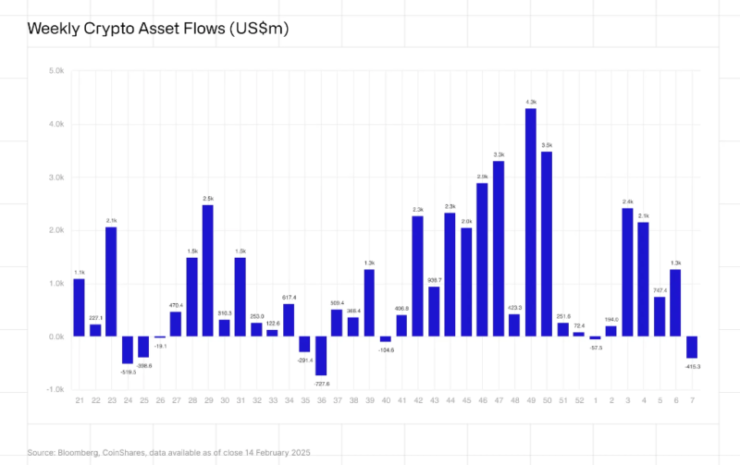

Digital asset investment products have recorded their first substantial outflows in 19 weeks, totaling $415 million. This downturn coincides with the Federal Reserve’s recent hawkish rhetoric and higher-than-anticipated inflation data, prompting investors to reassess their positions in the cryptocurrency market.

The outflows mark a departure from the prolonged inflow streak that amassed $29.4 billion post the U.S. election. Bitcoin (BTC) bore the brunt of these outflows, with investors withdrawing $430 million from BTC-focused investment products. Interestingly, there were no corresponding inflows into short-Bitcoin products, which instead saw outflows of $9.6 million. In contrast, altcoins like Solana (SOL), XRP, and Sui experienced inflows of $8.9 million, $8.5 million, and $6 million respectively, indicating selective investor confidence in alternative digital assets according to Coinshares data

Federal Reserve’s Influence

The Federal Reserve’s recent communications have played a pivotal role in shaping investor sentiment. Fed Chair Jerome Powell, in his testimony before Congress, signaled a more hawkish monetary policy stance, emphasizing the need for caution in adjusting interest rates amid persistent inflation concerns. This position was echoed by Fed Governor Michelle Bowman, who highlighted the necessity for stronger assurance that inflation will decrease further before considering additional interest rate cuts.

“I would like to gain greater confidence that progress in lowering inflation will continue as we consider making further adjustments, to a policy rate that the Fed is currently holding steady in the 4.25% to 4.5% range,” – Bowman said in remarks prepared for delivery to an American Bankers Association conference.

These statements, coupled with higher-than-expected Consumer Price Index (CPI) data, have led investors to anticipate a tighter monetary environment, prompting a reevaluation of risk assets, including cryptocurrencies.

Market Response and Broader Implications

The majority of outflows originated from the United States, totaling $464 million, suggesting that U.S.-based investors are particularly sensitive to domestic monetary policy signals. Conversely, countries like Germany, Switzerland, and Canada saw inflows of $21 million, $12.5 million, and $10.2 million respectively, indicating regional variations in investor behavior.

The outflows from cryptocurrency funds align with movements in traditional financial markets. For instance, the U.S. dollar index rose above 106.8, reversing a three-day decline, as Federal Reserve officials signaled a cautious approach to resuming interest rate cuts. This appreciation of the dollar often leads investors to pull back from riskier assets, including cryptocurrencies, in favor of more stable investments.

Current Cryptocurrency Market Overview

As of February 18, 2025, the cryptocurrency market reflects the recent investor caution:

- Bitcoin (BTC): Trading at $96,032, experiencing a slight decrease of 0.059% over the past 24 hours.

- Ethereum (ETH): Priced at $2,695.08, showing a modest increase of 0.0117% in the same period.

- Solana (SOL): Valued at $175.75, with a decline of 0.0449% over the last day.

These movements suggest a cautious market sentiment as investors digest the implications of the Federal Reserve’s stance and the latest inflation data.

Quick Facts:

- Digital asset investment products saw $415 million in outflows, ending a 19-week inflow streak.

- Bitcoin-focused funds experienced the largest withdrawals, totaling $430 million.

- Despite the trend, altcoins like Solana, XRP, and Sui attracted positive inflows.

- Hawkish statements from the Federal Reserve and unexpected inflation data have influenced investor decisions, leading to a reassessment of positions in risk assets.