Michigan has become the latest U.S. state to propose a strategic Bitcoin reserve bill, joining a growing list of 20 states considering cryptocurrency-backed financial policies. The bill, HB 4087, was introduced on February 13 by Representatives Bryan Posthumus and Ron Robinson, aiming to amend the state’s Management and Budget Act to establish a Bitcoin (BTC) reserve.

Key Provisions of Michigan’s Crypto Reserve Bill

The proposed legislation would authorize the Michigan Treasury to:

- Invest up to 10% of state funds from the general fund and economic stabilization fund into Bitcoin and other cryptocurrencies.

- Lend crypto assets to generate additional returns for the state, provided it does not increase financial risk.

- Hold cryptocurrency directly through secure custody solutions or via exchange-traded products from registered investment firms.

The bill does not specify which cryptocurrencies may be included in the reserve beyond Bitcoin, leaving room for potential diversification in digital asset investments.

Michigan’s Move in the National Crypto Policy Landscape

With this bill, Michigan becomes the 20th U.S. state with pending crypto reserve legislation. The most recent state to propose a similar measure was Texas, which filed legislation this week allowing state investments in and trading of crypto assets.

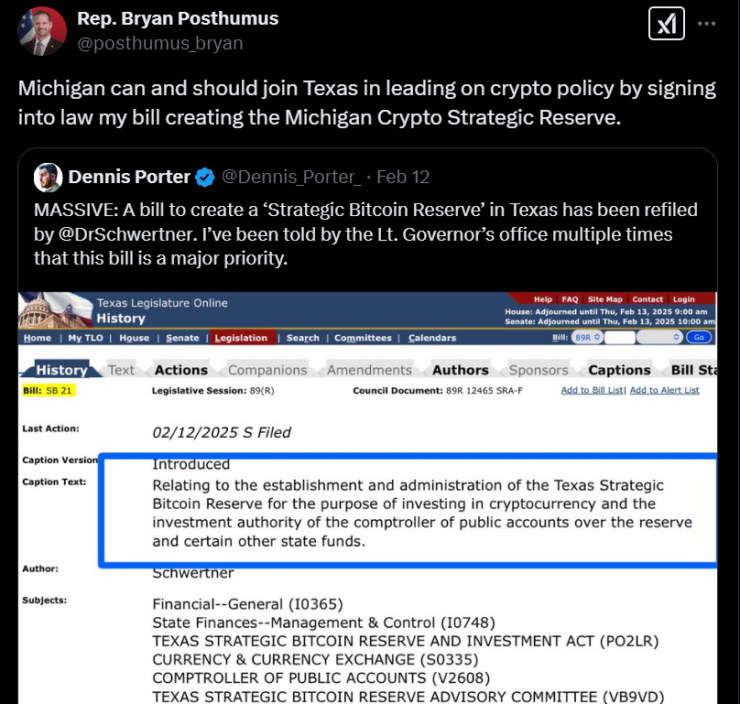

Texas Senator Charles Schwertner introduced a similar bill on February 12, with Posthumus advocating for Michigan to follow Texas’ lead in crypto policy.

“Michigan can and should join Texas in leading on crypto policy by signing into law my bill creating the Michigan Crypto Strategic Reserve,”

Posthumus stated on X.

Potential for a State-Issued Stablecoin

In addition to the Bitcoin reserve bill, Posthumus floated the idea of “MichCoin”, a state-backed stablecoin tied to Michigan’s gold and silver reserves. While no formal legislation has been introduced yet, the concept suggests a broader push for digital asset adoption at the state level.

State Pension Fund Already Has Crypto Exposure

Michigan’s state pension fund already has exposure to Bitcoin and Ethereum ETFs, reflecting growing institutional acceptance of crypto assets within state-managed financial portfolios.

Regulatory and Financial Implications

If enacted, the Michigan crypto reserve bill could:

- Modernize state financial policies by integrating blockchain-based assets into treasury management.

- Attract blockchain businesses and investors, making Michigan a crypto-friendly jurisdiction.

- Set a precedent for other states, reinforcing the trend of state-backed digital asset investments.

However, there are challenges, including volatility risks, security concerns, and federal regulatory oversight. The bill must navigate committee hearings and legislative approvals before it can be signed into law.

What’s Next?

Michigan’s proposed Bitcoin reserve bill represents a major step forward in state-level digital asset adoption. With 20 states actively considering similar measures, the trend of government-backed crypto reserves is gaining momentum.

If passed, Michigan would join states like Wyoming and Texas in integrating cryptocurrency into public finance, potentially paving the way for broader state-backed blockchain initiatives in the future.