In a controversial move, Russell Vought, appointed by former U.S. President Donald Trump as the acting head of the Consumer Financial Protection Bureau (CFPB), has announced a funding freeze and the suspension of the agency’s regulatory oversight activities. The decision has sparked criticism, with opponents arguing that it weakens consumer financial protections while potentially benefiting the financial and crypto industries.

Vought Cuts Off CFPB’s Funding, Orders Suspension of Activities

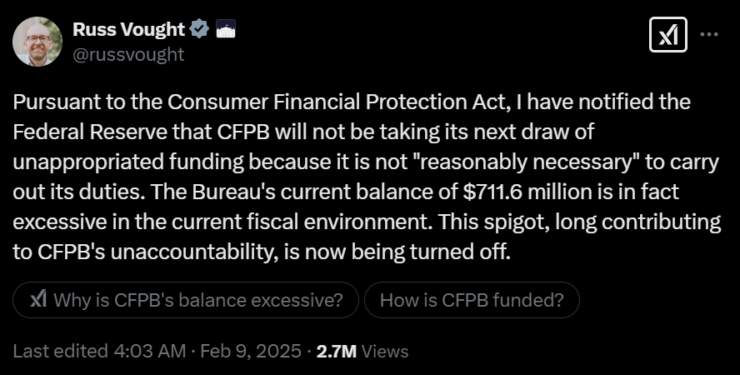

Vought declared in a February 9 X post that he had notified the Federal Reserve that the CFPB would not be taking its next draw of unappropriated funding, citing that it was not “reasonably necessary” for the agency’s operations.

“The Bureau’s current balance of $711.6 million is in fact excessive in the current fiscal environment,” Vought added.

The CFPB, originally established to protect consumers from abusive financial practices following the 2008 financial crisis, is responsible for regulating banks, money transfer firms, and financial institutions. It also monitors complaints related to U.S.-based crypto exchanges.

However, with Vought cutting off new funding, the agency’s ability to investigate predatory practices, enforce regulations, and issue guidance has been put in limbo.

Crypto Industry and Financial Firms Welcome the CFPB’s Weakening

The CFPB has been a target of the crypto industry for years. In 2023, the agency proposed supervising crypto wallet providers, only to later abandon the plan due to industry pressure. Still, crypto trade groups filed a lawsuit against the CFPB last month, calling its oversight attempts an “unlawful power grab.”

By halting regulatory oversight, Vought’s decision could create a more relaxed environment for financial firms and crypto businesses that have pushed back against CFPB supervision.

Regulatory Freeze: What This Means for Financial Oversight

According to Reuters, Vought also sent a memo to CFPB staff instructing them to “cease all supervision and examination activity”. Reports from Politico confirm that CFPB employees were:

- Ordered to stop all ongoing investigations and refrain from opening new ones.

- Told to halt the issuance of rules, guidance, and public comments.

- Informed that CFPB offices would be closed for the week, with employees required to work remotely.

These actions effectively paralyze the CFPB, preventing it from holding financial institutions accountable for fraudulent or predatory practices.

The Political Power Struggle Behind the CFPB Freeze

The CFPB is not funded through Congress like most federal agencies; instead, it receives budget requests directly from the Federal Reserve. Vought justified cutting off this funding, stating:

“This spigot, long contributing to CFPB’s unaccountability, is now being turned off.”

Vought, who also directs the White House’s Office of Management and Budget, took over as acting CFPB head on February 7, replacing Treasury Secretary Scott Bessent. He was also a co-author of Project 2025, a right-wing policy initiative aimed at reshaping the U.S. government to concentrate executive power under the president.

Critics Slam the Move as an Attack on Consumer Protection

Consumer protection advocates have condemned the decision, warning that it leaves everyday Americans vulnerable to predatory financial practices.

Dennis Kelleher, co-founder of Better Markets, issued a February 9 statement blasting the move:

“This latest attempt to kill the consumer bureau is another slap in the face for all Americans who depend on basic financial products and services, but especially for those in the multi-racial working-class coalition of Americans that helped elect President Trump.”

Kelleher argued that by defunding the CFPB, Trump’s administration is abandoning its own supporters, exposing them to predatory lenders, fraudulent financial schemes, and weakened consumer protections.

What Comes Next?

With funding frozen and oversight suspended, the fate of the CFPB remains uncertain. The agency was originally designed to be independent from political influence, but Vought’s drastic measures could set a precedent for future administrations to weaken financial regulations at will.

While the financial and crypto industries may welcome reduced oversight, consumer protection groups warn that it could lead to increased fraud, weakened enforcement, and economic instability.

As legal and political battles unfold, the debate over the role of the CFPB, regulatory accountability, and financial consumer protection is far from over.