Quick Facts:

- Metaplanet’s Bitcoin holdings have generated $35 million in unrealized gains in 2024.

- The Japanese firm has been aggressively accumulating BTC as a treasury reserve asset.

- Bitcoin’s strong market performance has fueled the company’s strategic financial growth.

- Metaplanet is often compared to MicroStrategy for its corporate Bitcoin accumulation strategy.

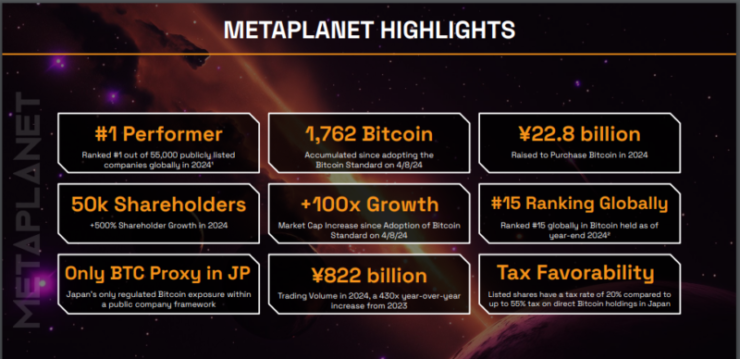

Metaplanet, the Japan-based public company often referred to as Asia’s MicroStrategy, has recorded $35 million in unrealized gains in 2024, thanks to its growing Bitcoin treasury holdings. The firm’s BTC-focused investment strategy has continued to pay off, reinforcing its position as one of Asia’s largest corporate Bitcoin holders.

Since shifting its financial strategy to prioritize Bitcoin as a treasury asset, Metaplanet has steadily accumulated BTC, seeing it as a long-term hedge against fiat currency volatility and inflation. The move mirrors the approach taken by Michael Saylor’s MicroStrategy, which has been at the forefront of corporate Bitcoin adoption.

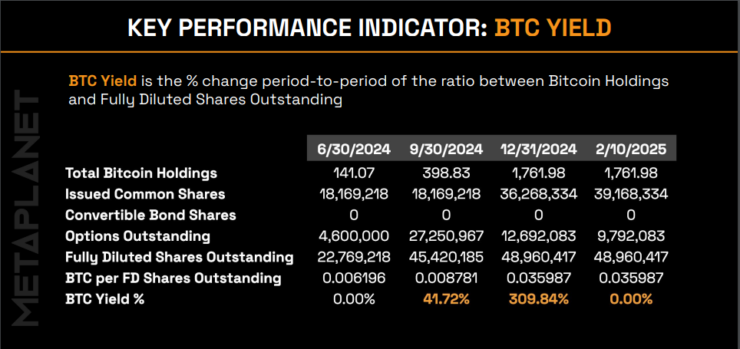

In its 2024 full-year financial results , the Bitcoin treasury company announced an unrealised gain of approximately $36 million (5.46 billion yen) from a stash of 1, 762 BTC holding, acquired for approximately $137 million.

The Bitcoin asset holder also announced that it increased its shareholder base by 500% to 50,000 in 2024.

More Bitcoin Acquisitions on the Horizon?

According to the latest filings, Metaplanet has significantly expanded its Bitcoin reserves over the past year, taking advantage of price dips to accumulate more BTC. The firm’s leadership has hinted at continued purchases, reinforcing its commitment to Bitcoin as a key asset in its balance sheet.

The Company is also setting ambitious targets for its Bitcoin reserves, planning to accumulate 10,000 BTC by the end of 2025 and 21,000 BTC by 2026, making it one of the most aggressive Bitcoin treasury strategies in Japan. The company intends to fund these purchases by issuing 21 million shares through moving strike warrants, a method that aligns with its long-term vision of maximizing Bitcoin exposure.

To achieve this goal, Metaplanet has outlined multiple financial mechanisms to increase its Bitcoin holdings per share. The firm is considering debt issuance strategies such as secured bonds, convertible bonds, and Bitcoin-backed loans. Additionally, equity issuance through private placements, preference shares, and warrants will supplement the accumulation process.

Metaplanet’s hybrid approach to Bitcoin accumulation has drawn comparisons to Strategy’s leveraged BTC strategy, which has been closely watched by institutional investors, and praised by analysts as the flagship model for institutional Bitcoin accumulation.