Quick Facts:

- The House Financial Services Committee held a hearing on February 6, focusing on allegations of U.S. regulators pressuring banks to cut ties with crypto firms.

- Coinbase CLO Paul Grewal called out financial agencies for “regulation by exhaustion,” arguing that banks are quietly pushed away from crypto clients.

- The Senate Banking Committee also examined the issue, with Anchorage Digital Bank CEO Nathan McCauley testifying that his company was abruptly debanked.

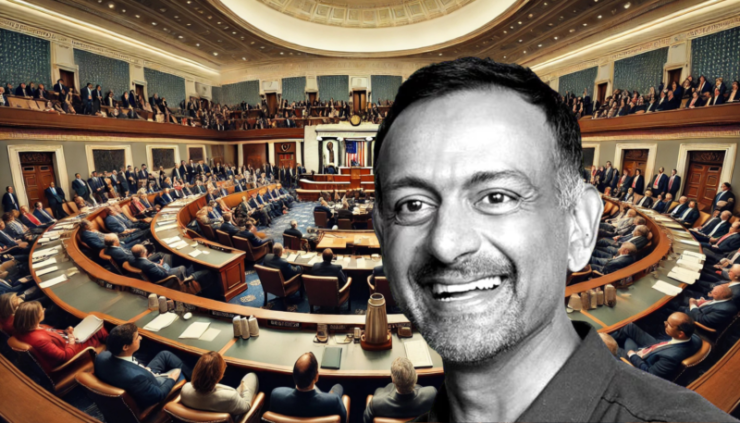

The battle over crypto firms’ access to banking services reached a new level of intensity in Washington this week as lawmakers clashed over allegations of financial discrimination against the digital asset industry. The House Financial Services Committee’s Oversight and Investigations Subcommittee held a high-stakes hearing on February 6, with industry leaders and regulators debating whether banks have been pressured to cut ties with crypto firms in a move critics call “Operation Choke Point 2.0.”

At the center of the debate was Paul Grewal, Chief Legal Officer of Coinbase, who testified before lawmakers about the difficulties crypto companies face in maintaining banking relationships. Grewal argued that U.S. financial regulators, including the FDIC, have engaged in a coordinated effort to pressure banks into distancing themselves from crypto businesses—despite publicly claiming neutrality.

“What we are seeing is regulation by exhaustion. There is no clear rulebook, just vague threats and punitive actions that have driven banks away from crypto firms,” Grewal stated during the hearing.

Partisan Divide Over Crypto Banking Regulation Intensifies

The House Financial Services Committee hearing quickly became a battleground for partisan clashes, with Republicans blasting Biden-era regulators for allegedly stifling the industry, while Democrats defended the cautious approach of financial watchdogs.

Coinbase Chief Legal Officer Paul Grewal’s concerns about “regulation by exhaustion” resonated strongly with Republican lawmakers, who accused federal agencies of quietly discouraging banks from working with crypto firms while publicly maintaining a neutral stance on digital assets.

Representative Dan Meuser, a Pennsylvania Republican leading the subcommittee, went on the offensive, claiming that financial regulators used veiled threats, vague regulatory guidance, and punitive measures to coerce banks into severing ties with crypto businesses.

“Biden regulators resorted to vague, interpretive regulatory letters threatening banks with negative examination scores and fines if they continue their partnership with digital asset companies,” Meuser said.

“This is serious overreach, one that not only undermines innovation but directly harms consumers by restricting their access to new and beneficial financial products.”

On the other side of the aisle, Democrats pushed back, arguing that asking banks to assess the risks of dealing with the crypto sector was not the same as outright debanking.

“Regulators asking banks to consider the risk associated with the cryptocurrency industry does not amount to debanking, as my Republican friends are indicating,” said Representative Al Green, a Texas Democrat and ranking subcommittee member.

“Regulators simply urged banks to exercise caution when dealing with this emerging and potentially risky industry.”

However, Democratic lawmakers also questioned Trump’s direct involvement in the crypto sector, pointing to his business dealings and ongoing promotion of digital assets, suggesting that his administration’s pro-crypto stance might be influenced by personal financial interests rather than sound policy.

Senate Banking Committee Examines Broader “Debanking” Trends

A day before the House hearing, the Senate Banking Committee also convened a session to discuss the broader issue of “debanking” across various industries, including digital assets. Committee Chair Tim Scott raised concerns that crypto firms are being unfairly cut off from financial services, with no formal justification from regulators.

During the session, Anchorage Digital Bank CEO Nathan McCauley testified that his company had its accounts abruptly shut down by a partner bank, with no explanation other than discomfort with crypto clients.